Fraud and Security

Phishing

The fraudulent practice of sending emails or other messages purporting to be from reputable companies in order to induce individuals to reveal personal information, such as passwords and credit card numbers. Fraudsters are known to use phishing emails, phone scams, and SMS attacks (text messaging).

Phishing is like fishing, but instead of trying to catch fish, scammers try to catch your personal information like passwords, credit card numbers, or other sensitive data by pretending to be someone trustworthy, like a financial institution or a company. Be careful and don't take the bait!

How to Protect yourself from Phishing

1. NEVER provide your personal or account information in response to an unsolicited request, whether over the phone or over the Internet. Fraudsters can spoof phone numbers tricking you into thinking they are calling from a trusted business. Fraudsters create emails and internet pages that look like real sites and can even fake a padlock icon to indicate that it is a secure site. If you did not initiate the communication, you should NOT provide any information.

2. If you believe the contact may be legitimate, contact the financial institution yourself. Locate the phone numbers from a monthly statement or go directly to www.securitycu.org for contact information. The key is that you should be the one to initiate the contact, using contact information that you have verified yourself.

3. NEVER provide your password, PIN, or account information over the phone or in response to an unsolicited request. A financial institution would never ask you to verify your online banking passwords or debit card PIN. Thieves armed with this information and your account can help themselves to your savings.

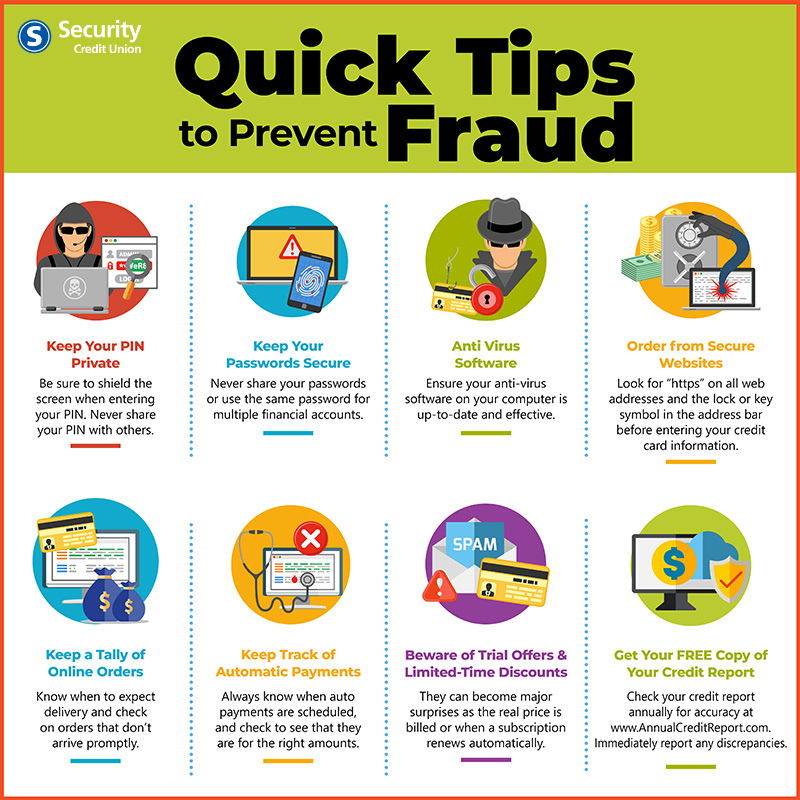

***Additional Tips

- Avoid donating or purchasing gifts through Social Media ads. Many times, these are knock offs.

- Read Terms and Conditions for Trial offers, online sweepstakes, or product giveaways.

- Check the URL by hovering over the address in the address bar and double check where the link is sending you.

- Don't send money to people you don't know or engage in unsolicited phone calls.

- Beware of anyone who asks for your PIN. Remember that PIN stands for personal identification number but should be private identification number.

- Beware of anyone asking you to send money using gift cards, Bitcoin, or any person-to-person payment service (Cash App, Venmo, Zelle, PayPal).

- Be aware of anyone threatening you or pressuring you to make a quick decision.

- Fraudsters can spoof phone numbers of legitimate businesses to confuse or trick people into thinking they are talking to a trusted business. The AARP advises to never trust caller ID.

- If it's too good to be true, it's probably a SCAM!

Always Pause, Think, and Trust your instincts!

Someone sending you money?

Someone sending you money?

You could be a money mule!

Money mules are people who, at someone else’s direction, receive and move money obtained from victims of fraud. Some money mules intentionally help fraudsters. Other money mules do not realize they are involved in illegal activity and believe they are following an employer’s directions or participating in a legitimate business. These individuals unwittingly enable fraudsters to harm others.

CAUTION

If something sounds too good to be true, it most likely is. To avoid becoming a money mule, ask yourself these questions before exchanging money with someone:

1. Was the offer of earning money too easy?

You received an unsolicited email or contact over social money for little or no effort. You may be referred to as an “employee.”

2. Was getting the job too easy?

You were hired without a formal interview process. You were onboarded through social media.

3. What do I do?

You have no written job description that defines your responsibilities and compensation. You don’t have a regular pay schedule or rate.

4. Why do I need to deposit money in my account or open a new account?

You a re asked to deposit money in:

- Your existing bank account,

- A new account in your name or

- A new account in the name of a company you form. Your “employer” may also request your ID and passcode so they can access the money directly.

5. Who am I sending the money to?

Your online “employer,” whom you have never met in person, asks you to forward the funds you received to them or someone you do not know.

6. How am I sending this money?

Your online “employer,” whom you have never met in person, asks you to forward the funds you received to them or someone you do not know.

You are instructed to move the money through a service. Legitimate payment methods are used by criminals to conduct illegal activities.

Examples include:

- Money service businesses (e.g.,

Western Union, MoneyGram). - Bank services (e.g., wire transfer,

ACH). - Digital currency/crypto.

- Gift cards.

- Peer-to-peer applications

(e.g., PayPal, Venmo, Zelle). - ATM cash outs.

7. How much can I keep?

You are told to keep a portion of the money you transfer.

STOP! BEING A MONEY MULE IS ILLEGAL!

You can be prosecuted and incarcerated as part of a criminal laundering conspiracy, even if you are unaware you are committing a crime. If you suspect you’ve been a money mule, please contact your financial institution for guidance on how to report it.

1. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them. Use of company names is for illustrative purposes only and does not imply any company involvement with wrongdoing or illegal activity.

Someone sending you money?

Someone sending you money?